Capital One offers several variants of its flagship 1.5% cash back credit cards, two of which are the card_name and card_name. The card_name is for…

PETRAVU Posts

Don’t think of the card_name as a hotel credit card; think of it as a travel credit card with significant Marriott perks. The premium metal…

It’s possible to get a secured credit card even if you have bad credit or no credit at all. The OpenSky® Secured Visa® Credit Card…

Nuk ka më Lotari Amerikane, Shqipëria mes 75 shteve që u pezullohen vizat e emigrimit Lajmi i ditës padyshim sot ishte vendimi i SHBA për…

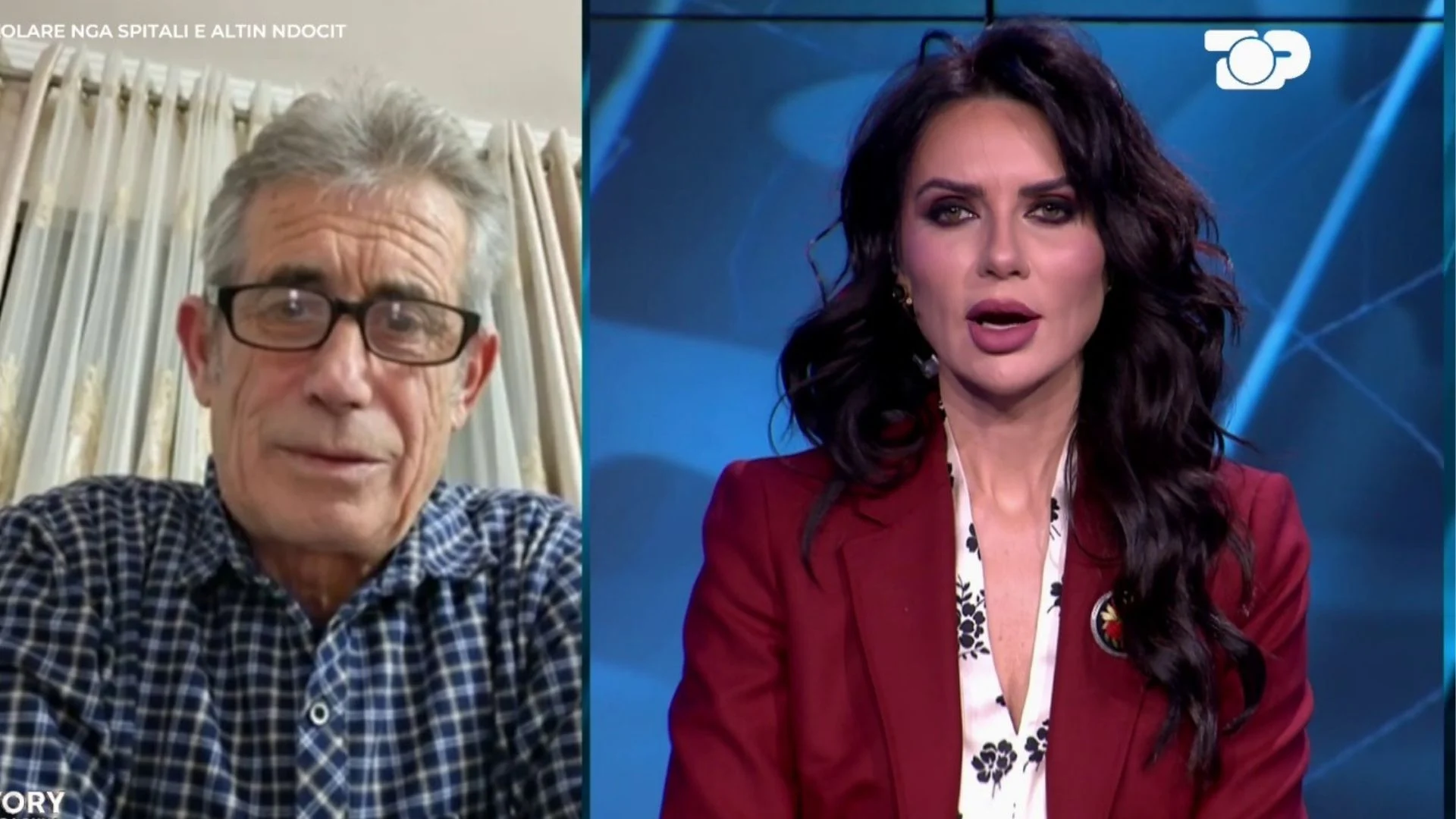

ikollë Ndoci, babai i të arratisurit nga paraburgimi i Durrësit, Altin Ndoci i akuzuar për 4 vrasje ishte sonte në lidhje direkte me studion e…

In 2026, the global financial landscape is characterized by a complex interplay between traditional equity markets and decentralized finance (DeFi). For investors seeking to preserve…

Komisioni Europian ka njoftuar zyrtarisht qeverinë shqiptare për ngrirjen pa afat të financimeve me argumentin e mbrojtjes së interesit të taksapaguesve të BE-së. Vjedhjet e…

Nga Ylli Manjani E përshëndes nismën e Ministrit të Drejtësisë për amnisti penale. Padyshim, kemi sistemin më agresiv penal në Europë dhe si i tillë…

Një tjetër vendim i rrufeshëm është marrë nga presidenti i Shteteve të Bashkuara të Amerikës, Donald Trump. Pas pezullimit përkohësisht të lotarisë amerikane, ai ka…

Në lidhje live për një emision televiziv gazetarja Aida Topalli tha se arratisja e Altin Ndocit ditën e djeshme nga burgu i Durrësit nuk erdhi…

Java që nisi është plot me energji astrologjike që sjellin si mundësi ashtu edhe sfida, varësisht nga shenja juaj e zodiakut. Në astrologji, ndikimet planetare…

Ambasada e Shteteve të Bashkuara ka reaguar ndaj përpjekjeve për sigurimin e dokumenteve të emigracionit përmes martesave fiktive, duke paralajmëruar se këto praktika përbëjnë shkelje…

“Unë dhe Edi Rama kemi qenë shokë klase.” Kështu është shprehur Ferdinand Duka në një intervistë për gazetaren Rudina Xhunga, në emisionin “Shqip” në DritareTV.…